Why is it so difficult to divest a business at the right time or to exit a failing project and redirect corporate resources? Many factors play a role, from the fact that managers who shepherd an exit often must eliminate their own jobs to the costs that companies incur for layoffs, worker buyouts, and accelerated depreciation. Yet a primary reason is the psychological biases that affect human decision making and lead executives astray when they confront an unsuccessful enterprise or initiative. Such biases routinely cause companies to ignore danger signs, to refrain from adjusting goals in the face of new information, and to throw good money after bad.

In contrast to other important corporate decisions, such as whether to make acquisitions or enter new markets, bad timing in exit decisions tends to go in one direction, since companies rarely exit or divest too early. An awareness of this fact should make it easier to avoid errors—and does, if companies identify the biases at play, determine where in the decision-making process they crop up, and then adopt mechanisms to minimize their impact. Techniques such as contingent road maps and tools borrowed from private equity firms can help companies to decide objectively whether they should halt a failing project or business and to navigate the complexities of the exit.

The decision-making process for exiting a project, business, or industry has three steps. First, a well-run company routinely assesses whether its products, internal projects, and business units are meeting expectations. If they aren't, the second step is the difficult decision about whether to shut them down or divest if they can't be improved. Finally, executives tackle the nitty-gritty details of exiting.

Each step of this process is vulnerable to cognitive biases that can undermine objective decision making. Four biases have significant impact: the confirmation bias, the sunk-cost fallacy, escalation of commitment, and anchoring and adjustment.

Confirmation bias

Managers who seek out the information supporting the argument and discount that which doesn’t usually get confirmation bias symptom..

Business evaluators rarely seek data to disprove the contention that a troubled project or business will eventually come around. Instead, they seek market research trumpeting a successful launch, quality control estimates predicting that a product will be reliable, or forecasts of production costs and start-up times that would confirm the success of the turnaround effort. Indeed, reports of weak demand, tepid customer satisfaction, or cost overruns often give rise to additional reports that contradict the negative ones.

Sunk cost fallacies and escalation of commitment

In deciding which project to exit, the sunk-cost fallacy is the key bias affecting the decision-making process. Executives often focus on the unrecoverable money already spent or on the project-specific know-how and capabilities already developed. A related bias is the escalation of commitment: yet more resources are invested, even when all indicators point to failure. This misstep, typical of failing endeavors, often goes hand in hand with the sunk-cost fallacy, since large investments can induce the people who make them to spend more in an effort to justify the original costs, no matter how bleak the outlook. When anyone in a meeting justifies future costs by pointing to past ones, red flags should go up; what's required instead is a levelheaded assessment of the future prospects of a project or business.

Anchoring and adjustment

Decision makers don't sufficiently adjust future estimates away from an initial value. Early estimates can influence decisions in many business situations, and this bias is particularly relevant in divestment decisions. There are three possible anchors. One is tied to the sunk cost, which the owner may hope to recover. Another is a previous valuation, perhaps made in better times. The third—the price paid previously for other businesses in the same industry—often comes up during merger waves, as it did recently in the consolidation of dot-com companies. If the first company sold for, say, $1 billion, other owners may think that their companies are worth that much too, even though buyers often target the best, most valuable company first.

To avoid falling into the above psychological trap, we can use the tools which have been already developed to overcome the universal human bias.

One tool that can help executives overcome biases and make more objective decisions is a contingent road map that lays out signposts to guide decision makers through their options at predetermined checkpoints over the life of a project or business. Signposts mark the points when key uncertainties must be resolved, as well as the ensuing decisions and possible outcomes. For a contingent road map to be effective, specific choices must be assigned to each signpost before the project begins (or at least well before the project approaches the signpost). This system in effect supplies a precommitment that helps mitigate biases when the time to make the decision arrives.

To get away from anchoring and adjustment, it is necessary to bring independent outsider to evaluate a business under divestment. Because the outsider have never seen the initial projections of its value, uninfluenced by these earlier estimates, the reviews of such people will take into account nothing but the project's actual experience, such as the evolution of market share, competition, and cost etc.

Although canceling a project or exiting a business may often be regarded as a sign of failure, such moves are really a perfectly normal part of the creative-destruction process. Companies need to realize that in this way they can free up their resources and improve their ability to embrace new market opportunities.

Tuesday, August 21, 2007

Thursday, August 16, 2007

Competing region, competing mindset

With global trade as a percent of GDP increasing from some 20 percent in the early 1970s to about 55 percent in 2003, business is rapidly becoming global. Whilst as the second largest economy in the world, Europe’s performance is lackluster comparing with U.S and emerging Asia.

How to get the Europe back to the right track and achieve the goal set by Lisbon Strategy which aims to turn EU into the most competitive and dynamic knowledge based economy in the world? The answer lies on the creation of a unitary competition climate by each individual Europe country and the competing mentality held by most European people.

Upfront Challenge

Economic activity slows down in the Europe area, the employment rate is sagging and the business environment is getting worse steadily. In addition, each country holds different priority and political agendas, consequently the breach of multilateral agreements and pacts is stepping up, which leads to the intense friction between countries.

Europe also falls consistently behind the U.S.A. with approximate 2% lag over a long period time. Globalization brings competitive pressures not only on labor intensive industrial sectors but also on high-value and high-tech sectors. Moreover, the ageing European population also poses potential risk that would cripple the social security systems.

It is an urgency to inject the necessary dynamism and inspiration into Europe and its people in order to make European industry more competitive vis-à-vis its major global competitors.

Create benign competition climate

The benign competition climate is the set of factors spurring efficiency, stimulating innovation, spawning entrepreneurship and building synergy. Market force and government policies and sponsorship are two inputs that shape the benign competition climate.

Under current situation in the Europe, there is one illusion that treats the globalization and competition as the specters threatening European societies. However, regressing to heavy-handed state intervention and protectionism in order to fend off global competition would doom to be a failure. In the contrast, globalization is a win-win game instead of a win-lose game. An open and competitive market within a globalizing economy is able to deliver growth in one part of the world and simultaneously creates a wave of opportunities elsewhere too. Defensive action” – protectionism – would cut Europe off from the global market place it needs to engage to ensure economic growth and the sustainability of social models. To reach a high level of competitiveness Europe is required not only to focus on global competition, but also on competition inside the European Union and at national level. A competitive market will surely boost efficiency, encourage innovation, ensure long-term growth and raise the standards of living for everyone. Competition also makes companies strong and adaptable. So competition at home makes sure that businesses will also be able to successfully compete abroad.

Although it is widely accepted by the economists that markets are usually much better at allocating economic resources than government, orderly market conditions can not be established automatically. This is why smart government policies and sponsorship are crucial to make sure that the competition in the market place cranks out the expected outcome.

First of all, the policy should be competition-oriented. Government will support business entities that are willing to participate the competition regionally and internationally rather than provide solo economic shield that would only encroach on the efficiency and push up the price.

Second, the policy should aim at creating an atmosphere that promotes entrepreneurship in terms of financial aid, legal support and tax relief or exemption. As a very active element in the market, entrepreneurship makes great contribution to form a competition climate, drive economic growth and create quality jobs.

Third, government’ sponsorship should target on what is needed to revive Europe’s competitive edge. For example, government should grant financial back-up to company’s R&D activities in order to boost innovation.

Last but not the least important, European countries should build synergy that can leverage the whole Europe’s competition capability. To reap the maximum benefit from this end, a unitary competition policy aiming at enhancing the European’s competency should be adopted and honored by every European country. When the synergy is gained, the full potential of Europe will be unlocked and Europe will become much stronger in the global market. This conclusion can be further proved by a recent OECD study (Title: “The Benefits of Liberalising Product Markets”[1]), which suggests that aligning the different European national economic policies with the most competition friendly regimes would result in huge benefits for the European economy overall: a 2 to 3,5 % growth in GDP per capita.

Nevertheless, this is quite a challenging task for all the Europe countries. Although EU has achieved single currency and single market, the diversity of the member countries is still large. Not mention the other countries out of EU, which are still far behind the EU countries. The divergence inevitably creates the parochialism. It is tempting for individual country to deviate from a collective agreement with the purpose of addressing domestic political and economical agendas. However, this kind of economic patriotism twist the market force’s efficiency to allocates economic resource. In the short run, some industries might fend off the competition by the inappropriate government subsidization, but in the long run, these industries will become vulnerable or even terminated when the external competition force overtake the protection of the government.

If the competition climate could be established correctly, it would become the corner stone to elevate efficiency, stimulate entrepreneurship and encourage companies to innovate. The benign competition climate will incubate two desired outputs, the sustainable economic development and the better social benefit for every European citizen.

Competing Mentality.

Europe is facing great challenge internally and externally. If competition is the weapon to battle with this challenge, the people who will fight this war must be trained to use this weapon artfully.

Mentality is the attitude of mind or the way of thinking. Government policies and market force can create the hardware of the competition climate. But without the competing mentality to follow, the system will go nowhere without the right mentality working as the software. Especially under current circumstance, globalization and competition are not popular in European’s dictionary. Re-shaping people’s perception toward competition is also an indispensable step to form the benign competition climate.

To shape competing mentality, three pillars must be planted. The three pillars are Propaganda, Participation and Protection.

Propaganda

Mentality is a mindset, it can not be taught, but can be motivated. A thorough propaganda to extol the competing mentality should be launched across the Europe continent in order to increase people’s awareness to the sustainable benefit driven by the competition at the local level and global level. The idea must be made crystal clear, the benefits of competitiveness, growth and lasting social and environmental development are mutually reinforcing rather than unilaterally debilitating under a global competition context. The exposure also need extend to the next generation, from the child to the youth, they are the future of Europe and they should know what is ahead of them and what they should prepare for.

Participation.

Both top-down and bottom-up methodology should be applied to build a competing mentality. Through top-down, all the European government, European Commission, local administrations and other public organizations need to permeate the concept of competition in their polices, regulations and statute. All the administrators should be proactively engaged in the promotion for the competition. EU plays an extremely role in this process because it represents the most influential parts of the Europe and it is the light house that guides the route of all European countries. It also has its authoritative and political power to make things happen.

Through bottom-up, the engagement of all the European citizens and private sectors is pivotal too. What they demand, concern and support determines whether this dynamic change can be successful. Their voice must be heard and heard clearly. If and only if their participation became active, the adversity occurring along the way of moving forward could be understood and accepted because the people who play the game also make the game rules.

Protection

Protection seems to be on the opposite side of competition. Whereas here the protection is at the social dimension rather than at the economic dimension. Out of the question, competition will bring long-run benefit to the whole Europe. But we have to keep in mind that those benefits will not be evenly distributed across the society. Competition do make winner and losers. The bankruptcy, unemployment and even poverty will still exist for a long period of time under the competitive business environment. They are the prices that have to pay and they will level off when the benign competition climate fully forms and functions. However, the solace offered by government and other institutions is still critical to maintain the social security and stability which are essential to maintain a friendly business environment. Besides, the protection also shoulders another very important responsibility of re-training the European workforce so they can fit in a knowledge-based economy and become more competitive. As a matter of fact, this would be the utmost protection for the European people.

Conclusion

Europe has prodigious potential. The enlargement of EU continues and the integration of the Europe accelerates. The 500 million people are invaluable assets, holding world-class skills and innovation capabilities. But Europe has not achieved the supernova performance commensurate with its abilities not only because of the ailing economic framework but also due to the low spirit and tumbling confidence. To unleash Europe’s enormous potential and rejuvenate its glory, a competition strategy and a dose of inspiration are necessary. In 14th century, Europe germinated the renaissance that brought immense impact on civilization and human history. In 21th century, I believe that a united Europe and its inspirational people will thrive again on the crest of the globalization wave and become the role model for the rest of the world. An inspired Europe will also inspire the world.

How to get the Europe back to the right track and achieve the goal set by Lisbon Strategy which aims to turn EU into the most competitive and dynamic knowledge based economy in the world? The answer lies on the creation of a unitary competition climate by each individual Europe country and the competing mentality held by most European people.

Upfront Challenge

Economic activity slows down in the Europe area, the employment rate is sagging and the business environment is getting worse steadily. In addition, each country holds different priority and political agendas, consequently the breach of multilateral agreements and pacts is stepping up, which leads to the intense friction between countries.

Europe also falls consistently behind the U.S.A. with approximate 2% lag over a long period time. Globalization brings competitive pressures not only on labor intensive industrial sectors but also on high-value and high-tech sectors. Moreover, the ageing European population also poses potential risk that would cripple the social security systems.

It is an urgency to inject the necessary dynamism and inspiration into Europe and its people in order to make European industry more competitive vis-à-vis its major global competitors.

Create benign competition climate

The benign competition climate is the set of factors spurring efficiency, stimulating innovation, spawning entrepreneurship and building synergy. Market force and government policies and sponsorship are two inputs that shape the benign competition climate.

Under current situation in the Europe, there is one illusion that treats the globalization and competition as the specters threatening European societies. However, regressing to heavy-handed state intervention and protectionism in order to fend off global competition would doom to be a failure. In the contrast, globalization is a win-win game instead of a win-lose game. An open and competitive market within a globalizing economy is able to deliver growth in one part of the world and simultaneously creates a wave of opportunities elsewhere too. Defensive action” – protectionism – would cut Europe off from the global market place it needs to engage to ensure economic growth and the sustainability of social models. To reach a high level of competitiveness Europe is required not only to focus on global competition, but also on competition inside the European Union and at national level. A competitive market will surely boost efficiency, encourage innovation, ensure long-term growth and raise the standards of living for everyone. Competition also makes companies strong and adaptable. So competition at home makes sure that businesses will also be able to successfully compete abroad.

Although it is widely accepted by the economists that markets are usually much better at allocating economic resources than government, orderly market conditions can not be established automatically. This is why smart government policies and sponsorship are crucial to make sure that the competition in the market place cranks out the expected outcome.

First of all, the policy should be competition-oriented. Government will support business entities that are willing to participate the competition regionally and internationally rather than provide solo economic shield that would only encroach on the efficiency and push up the price.

Second, the policy should aim at creating an atmosphere that promotes entrepreneurship in terms of financial aid, legal support and tax relief or exemption. As a very active element in the market, entrepreneurship makes great contribution to form a competition climate, drive economic growth and create quality jobs.

Third, government’ sponsorship should target on what is needed to revive Europe’s competitive edge. For example, government should grant financial back-up to company’s R&D activities in order to boost innovation.

Last but not the least important, European countries should build synergy that can leverage the whole Europe’s competition capability. To reap the maximum benefit from this end, a unitary competition policy aiming at enhancing the European’s competency should be adopted and honored by every European country. When the synergy is gained, the full potential of Europe will be unlocked and Europe will become much stronger in the global market. This conclusion can be further proved by a recent OECD study (Title: “The Benefits of Liberalising Product Markets”[1]), which suggests that aligning the different European national economic policies with the most competition friendly regimes would result in huge benefits for the European economy overall: a 2 to 3,5 % growth in GDP per capita.

Nevertheless, this is quite a challenging task for all the Europe countries. Although EU has achieved single currency and single market, the diversity of the member countries is still large. Not mention the other countries out of EU, which are still far behind the EU countries. The divergence inevitably creates the parochialism. It is tempting for individual country to deviate from a collective agreement with the purpose of addressing domestic political and economical agendas. However, this kind of economic patriotism twist the market force’s efficiency to allocates economic resource. In the short run, some industries might fend off the competition by the inappropriate government subsidization, but in the long run, these industries will become vulnerable or even terminated when the external competition force overtake the protection of the government.

If the competition climate could be established correctly, it would become the corner stone to elevate efficiency, stimulate entrepreneurship and encourage companies to innovate. The benign competition climate will incubate two desired outputs, the sustainable economic development and the better social benefit for every European citizen.

Competing Mentality.

Europe is facing great challenge internally and externally. If competition is the weapon to battle with this challenge, the people who will fight this war must be trained to use this weapon artfully.

Mentality is the attitude of mind or the way of thinking. Government policies and market force can create the hardware of the competition climate. But without the competing mentality to follow, the system will go nowhere without the right mentality working as the software. Especially under current circumstance, globalization and competition are not popular in European’s dictionary. Re-shaping people’s perception toward competition is also an indispensable step to form the benign competition climate.

To shape competing mentality, three pillars must be planted. The three pillars are Propaganda, Participation and Protection.

Propaganda

Mentality is a mindset, it can not be taught, but can be motivated. A thorough propaganda to extol the competing mentality should be launched across the Europe continent in order to increase people’s awareness to the sustainable benefit driven by the competition at the local level and global level. The idea must be made crystal clear, the benefits of competitiveness, growth and lasting social and environmental development are mutually reinforcing rather than unilaterally debilitating under a global competition context. The exposure also need extend to the next generation, from the child to the youth, they are the future of Europe and they should know what is ahead of them and what they should prepare for.

Participation.

Both top-down and bottom-up methodology should be applied to build a competing mentality. Through top-down, all the European government, European Commission, local administrations and other public organizations need to permeate the concept of competition in their polices, regulations and statute. All the administrators should be proactively engaged in the promotion for the competition. EU plays an extremely role in this process because it represents the most influential parts of the Europe and it is the light house that guides the route of all European countries. It also has its authoritative and political power to make things happen.

Through bottom-up, the engagement of all the European citizens and private sectors is pivotal too. What they demand, concern and support determines whether this dynamic change can be successful. Their voice must be heard and heard clearly. If and only if their participation became active, the adversity occurring along the way of moving forward could be understood and accepted because the people who play the game also make the game rules.

Protection

Protection seems to be on the opposite side of competition. Whereas here the protection is at the social dimension rather than at the economic dimension. Out of the question, competition will bring long-run benefit to the whole Europe. But we have to keep in mind that those benefits will not be evenly distributed across the society. Competition do make winner and losers. The bankruptcy, unemployment and even poverty will still exist for a long period of time under the competitive business environment. They are the prices that have to pay and they will level off when the benign competition climate fully forms and functions. However, the solace offered by government and other institutions is still critical to maintain the social security and stability which are essential to maintain a friendly business environment. Besides, the protection also shoulders another very important responsibility of re-training the European workforce so they can fit in a knowledge-based economy and become more competitive. As a matter of fact, this would be the utmost protection for the European people.

Conclusion

Europe has prodigious potential. The enlargement of EU continues and the integration of the Europe accelerates. The 500 million people are invaluable assets, holding world-class skills and innovation capabilities. But Europe has not achieved the supernova performance commensurate with its abilities not only because of the ailing economic framework but also due to the low spirit and tumbling confidence. To unleash Europe’s enormous potential and rejuvenate its glory, a competition strategy and a dose of inspiration are necessary. In 14th century, Europe germinated the renaissance that brought immense impact on civilization and human history. In 21th century, I believe that a united Europe and its inspirational people will thrive again on the crest of the globalization wave and become the role model for the rest of the world. An inspired Europe will also inspire the world.

Mirror Neuron

Scientist find that there are unusual brain circuits are mirrors in the mind that reflect the actions and intentions of others as if they were our own, new research has revealed. Scientists call them mirror neurons. They allow us to feel a loved one's pain, or suffer the pangs of appetite when we hear someone crunch into an apple. They are a reason we are moved by the images of art and can feel the appeal of characters in a book. In pychology terminology, we call it empathy.

This finding also arouse the interest of marketers. Becuase these cells are subconscious seeds of social behavior that also can be manipulated to boost sales, generate fads or influence political beliefs.

But this idea of manipulating human being's mind annoys me. Nowaways, we are already bombarded by all kind of marketing weapons. As long as the purpose is to trigger our real interest rather than to hoodwind us, I am fine with it. There must be a certain constrains over how far the marketing tactics can go. Otherwise, it might be backfired. Actually I don't know how our mirror neurons will be manipulated. I don't think it would work for me by taking pills or taking electronic shocks. The most scary scenario is that we take the marketer's scam in an unconcitious way.

This finding also arouse the interest of marketers. Becuase these cells are subconscious seeds of social behavior that also can be manipulated to boost sales, generate fads or influence political beliefs.

But this idea of manipulating human being's mind annoys me. Nowaways, we are already bombarded by all kind of marketing weapons. As long as the purpose is to trigger our real interest rather than to hoodwind us, I am fine with it. There must be a certain constrains over how far the marketing tactics can go. Otherwise, it might be backfired. Actually I don't know how our mirror neurons will be manipulated. I don't think it would work for me by taking pills or taking electronic shocks. The most scary scenario is that we take the marketer's scam in an unconcitious way.

Wednesday, August 15, 2007

A dynamic view over strategy

Professor Richard Rumelt, a professor of strategy at UCLA’s Anderson School of Management, has achieved a number of first ascents. Rumelt challenged the dominant thinking with his controversial 1991 paper, “How much does industry matter?” His study, published in the Strategic Management Journal, showed that neither industries nor corporate ownership can explain the lion’s share of the differences in profitability among business units. Being in the right industry does matter, but being good at what you do matters a lot more, no matter what industry you’re in. This study was one of the first entries in what has since become a large body of academic literature on the resource-based view of strategy.

Rumelt is holding a pionner view over strategy. He thinks the annual strategic planning process in most of the companies is not strategy at all. It should be re-named as long-term resourc plans because the process is concerning property acquisition, construction, training, et cetera. This plan coordinates the deployment of resources—but it’s not strategy. These resource budgets simply cannot deliver what senior managers want: a pathway to substantially higher performanc.

In Rumelt's eyes, strategy is more about taking positions in front of changes. Senior management must make speculative judgements in the advent of changes. It is never easy to predict clearly which positions will pay off? Strategic thinking is essentially a substitute for having clear connections between the positions the company takes and their economic outcome.

He further states that most of the strategy concepts in use today are static. They explain the stability and sustainability of competitive advantages. Strategy concepts like core competencies, experience curves, market share, entry barriers, scale, corporate culture, and even the idea of “superior resources” are essentially static, but why a particular position is defensiblbe is not sufficiently addressed.

In the business nowadays, unlike geology, change happens in years rather than millennia. In the modern business world, there are earthquakes all the time that quickly take the low ground and raise it high and, at the same time, submerge some mountain peaks below water.

So to put strategy from a dynamics perspective, we should study how those changes would shift each dimension of an industry. Would the industry become more concentrated or less? More integrated or less? Would there be more product differentiation or less? More segmentation or less? Given consumer desires and available technologies, how should the industry or business look in, say, ten years? Where are the economic forces trying to take you? Should your strategy ride those forces or fight them?

In order to answer how the companies take the positions, Rumelt uses the concept of predatory leap. When the window of oppotunies is opened, the market leader was the company that was the first to successfully jump through that window. Not exactly the first mover but the first to get it right.

In reflection to Rumelt's theory, I agree with him that in a dynamic business world, we should also conceive strategy in a more motional manner. To quote him " Changes, however, don’t come along in nice annual packages, so the need for strategy work is episodic, not necessarily annual. " The episodic moment Prof. Rumelt refers to is the timing when the revolution in the industry is going to happen. Of course, if a CEO of the company has enough sensativity, he should immediately take the hint and make his bets. In Remelt's words, to make a predatory leap. However, we can not deny that although the cycle time of indursy revolution is significantly shortened, it still takes years to arrive. Companys still to figue out what they should do in a relatively static period of time. Therefore, the static strategy is not as facinating as a dynamic one, but it is still necessary.

According to Rumelt's definition, strategy is a pathway to substantially higher performanc. The performance can be acheived by jump across a window (if the other side of the window is not a cliff), or can be realized by a smart resource planning which allocate the right amount of the resource at the right place and at the right time.

To wrap up, strategy is very complicate stuff. There are so many dimenstion interwined and most of the time, we have judge it by result instead of process. A successful strategy needs business acumen, but it also needs a load of luck.

Rumelt is holding a pionner view over strategy. He thinks the annual strategic planning process in most of the companies is not strategy at all. It should be re-named as long-term resourc plans because the process is concerning property acquisition, construction, training, et cetera. This plan coordinates the deployment of resources—but it’s not strategy. These resource budgets simply cannot deliver what senior managers want: a pathway to substantially higher performanc.

In Rumelt's eyes, strategy is more about taking positions in front of changes. Senior management must make speculative judgements in the advent of changes. It is never easy to predict clearly which positions will pay off? Strategic thinking is essentially a substitute for having clear connections between the positions the company takes and their economic outcome.

He further states that most of the strategy concepts in use today are static. They explain the stability and sustainability of competitive advantages. Strategy concepts like core competencies, experience curves, market share, entry barriers, scale, corporate culture, and even the idea of “superior resources” are essentially static, but why a particular position is defensiblbe is not sufficiently addressed.

In the business nowadays, unlike geology, change happens in years rather than millennia. In the modern business world, there are earthquakes all the time that quickly take the low ground and raise it high and, at the same time, submerge some mountain peaks below water.

So to put strategy from a dynamics perspective, we should study how those changes would shift each dimension of an industry. Would the industry become more concentrated or less? More integrated or less? Would there be more product differentiation or less? More segmentation or less? Given consumer desires and available technologies, how should the industry or business look in, say, ten years? Where are the economic forces trying to take you? Should your strategy ride those forces or fight them?

In order to answer how the companies take the positions, Rumelt uses the concept of predatory leap. When the window of oppotunies is opened, the market leader was the company that was the first to successfully jump through that window. Not exactly the first mover but the first to get it right.

In reflection to Rumelt's theory, I agree with him that in a dynamic business world, we should also conceive strategy in a more motional manner. To quote him " Changes, however, don’t come along in nice annual packages, so the need for strategy work is episodic, not necessarily annual. " The episodic moment Prof. Rumelt refers to is the timing when the revolution in the industry is going to happen. Of course, if a CEO of the company has enough sensativity, he should immediately take the hint and make his bets. In Remelt's words, to make a predatory leap. However, we can not deny that although the cycle time of indursy revolution is significantly shortened, it still takes years to arrive. Companys still to figue out what they should do in a relatively static period of time. Therefore, the static strategy is not as facinating as a dynamic one, but it is still necessary.

According to Rumelt's definition, strategy is a pathway to substantially higher performanc. The performance can be acheived by jump across a window (if the other side of the window is not a cliff), or can be realized by a smart resource planning which allocate the right amount of the resource at the right place and at the right time.

To wrap up, strategy is very complicate stuff. There are so many dimenstion interwined and most of the time, we have judge it by result instead of process. A successful strategy needs business acumen, but it also needs a load of luck.

Experience marketing

Nowadays, Marketing is far more four Ps. As the pioneer of the marketing, P&G is creative to bring new approaches to detect what its customer needs and translate that into business.

This comes the Experience marketing. Staff from its Consumer and Market Knowledge division tour the world and spend entire days with women to observe how they shop, clean, eat, apply their make-up or put nappies on their babies. They try to understand how a woman reacts in the first three to seven seconds after she sees an item in a shop (the “First Moment of Truth”, in P&G-speak) and when she tries it at home (the “Second Moment of Truth”).

I am wondering whether the same approach can also be applied in chemical goods sales. Traditionally, the main theme of the chemical sales is the technology. Sales people focus on the issues like whether the product meets customer’s quality standard, lab test and technology seminars etc. No one even will think about the experience of the using of the product.

One product in my company usually is packed in big containers or canisters. One client told us that it is not convenience for him to handle the bulky containers because in his plant, the worker is using hand to pour the chemical compound into the reactors. He asks whether we can offer him the product in small package to facility the production process. Eventually we don’t gratify his demand and he switched to other suppliers. The story tells something unnoticed before, even in chemical business, how customers use the product is also important and can create business opportunities.

Salespeople infatuated with technology should stretch themselves a little bit and take time to observe customer’s experience to use the product. We should start from the cargo receiving area, follow the whole route the product go through the customer’s workshop. Talk with everyone who has the chance to touch our product and listen to their advice how we can make their experience more enjoyable. Through this way, we can attain two goal. First, the new way to design the product might emerge. Second, customer feels our sincerity and build stronger customer loyalty.

This comes the Experience marketing. Staff from its Consumer and Market Knowledge division tour the world and spend entire days with women to observe how they shop, clean, eat, apply their make-up or put nappies on their babies. They try to understand how a woman reacts in the first three to seven seconds after she sees an item in a shop (the “First Moment of Truth”, in P&G-speak) and when she tries it at home (the “Second Moment of Truth”).

I am wondering whether the same approach can also be applied in chemical goods sales. Traditionally, the main theme of the chemical sales is the technology. Sales people focus on the issues like whether the product meets customer’s quality standard, lab test and technology seminars etc. No one even will think about the experience of the using of the product.

One product in my company usually is packed in big containers or canisters. One client told us that it is not convenience for him to handle the bulky containers because in his plant, the worker is using hand to pour the chemical compound into the reactors. He asks whether we can offer him the product in small package to facility the production process. Eventually we don’t gratify his demand and he switched to other suppliers. The story tells something unnoticed before, even in chemical business, how customers use the product is also important and can create business opportunities.

Salespeople infatuated with technology should stretch themselves a little bit and take time to observe customer’s experience to use the product. We should start from the cargo receiving area, follow the whole route the product go through the customer’s workshop. Talk with everyone who has the chance to touch our product and listen to their advice how we can make their experience more enjoyable. Through this way, we can attain two goal. First, the new way to design the product might emerge. Second, customer feels our sincerity and build stronger customer loyalty.

Thursday, August 9, 2007

Make your points powerful

PowerPoint is the most widely used software to deliver presentations. But despite its ubiquity, many people are quite clueless about how to use the programme properly and end up boring their audience and missing their presentation target.

Actually creating a powerful PowerPoint presentation isn't rocket science, it's as simple as taking the time to understand what works and what doesn't. The following tips could be helpful to make your points powerful.

The biggest no-no is providing too much written content. People don't want to read paragraphs of text as well as hear the same information and the same time. They want to be engaged by the speaker, so bullet points will suffice. Bear in your mind that one picture worth a thousand words.

Don't expect the program itself to do all the work. "PowerPoint proponents say slideware doesn't bore people, people bore people." Make sure your presentation skills are up to scratch: a well thought-out, well-presented PowerPoint presentation should be complemented by the skills of an engaging, lively speaker.

Always keep the purpose of your presentation in your mind, which is to get your audience understand your viewpoints. Make a clear opening to cover the main topic of the presentation and make a clear ending to summerize your points. Never jam your persentation with complicate concepts and difficutl words. It would do nothing good except baffling your audiencde.

Get feedback. Don't fool yourself that your last presentation was good just because people clapped; they might have just been glad it was over. Before a major presentation ask colleagues for honest feedback that will help you hone your PowerPoint delivery skills.

Actually creating a powerful PowerPoint presentation isn't rocket science, it's as simple as taking the time to understand what works and what doesn't. The following tips could be helpful to make your points powerful.

The biggest no-no is providing too much written content. People don't want to read paragraphs of text as well as hear the same information and the same time. They want to be engaged by the speaker, so bullet points will suffice. Bear in your mind that one picture worth a thousand words.

Don't expect the program itself to do all the work. "PowerPoint proponents say slideware doesn't bore people, people bore people." Make sure your presentation skills are up to scratch: a well thought-out, well-presented PowerPoint presentation should be complemented by the skills of an engaging, lively speaker.

Always keep the purpose of your presentation in your mind, which is to get your audience understand your viewpoints. Make a clear opening to cover the main topic of the presentation and make a clear ending to summerize your points. Never jam your persentation with complicate concepts and difficutl words. It would do nothing good except baffling your audiencde.

Get feedback. Don't fool yourself that your last presentation was good just because people clapped; they might have just been glad it was over. Before a major presentation ask colleagues for honest feedback that will help you hone your PowerPoint delivery skills.

Factor in people-why people elments are import in strategy formulation

When we talk about strategy formulation, the scenario pops up in our mind is that cooperate planners are swamped by the analysis of financial and operation data, business forecasting, industrial trend, demand-supply dynamics, competitions and customers etc. Too often, people element in a strategic planning process is missing or downplayed because it is deemed to be unimportant or irrelevant factor. However, a lot of companies who don’t factor in people in their strategy formulation end up fighting an uphill battle in the implementation of their strategy which is thought flawless at the beginning.

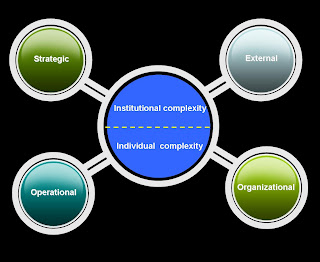

So why people factor is crucial in the equation of strategy formulation? The answer lies on the simple but always elusive fact that in any business environment we need to cope with two complexity,institutional complexity and individual complexity.

Institutional complexity stems from strategic choices (such as which industry the company is in and what product the company is producing) and the external context (such as the regulatory climate and marketing condition etc). It grows as an organization adds units or increases the number or diversity of the interactions among them—for instance, by moving into a new geography, serving a new customer, or opening a new manufacturing location.

Individual complexity is the way employees and managers experience and deal with complexity—in plain English, “how hard it is to get things done.”

Institutional complexity is more related to strategic planning and external context. Whereas individual complexity is more closed to operational and organizational choice. In other words, how to organize people and carry out the strategy.

Two people issues must be included and addressed in strategy formulation. First, reshape people’s paradigm to accept and embrace the changes implied by the corporate strategy construction. Second, evaluate the availability of people that is able to successfully execute the strategy.

At any business level, a strategy formulation always entails major changes in the organization. When all kinds of business factors and risks are carefully calculated in order to handle the possible major “climate” shifts, one loop in the chain often missing, which is how do we educate our people to deal with the changes.

Individuals don’t have a natural aptitude to adapt. Resistance to change is inevitable. People see changes in different perspective other than what the strategic planners usually assume. When people hear strategy, it immediately creates the fears and doubts in the minds of employees: Will I lose my job? Will I be good enough? Where will I fit in? Who will I be in the new organization?

Employees will alter their mind-sets only if they see the point of the change and agree with it—at least enough to give it a try. If these fears and doubts were not ironed out, the strategy would face enormous challenge to push through. To tackle this issue, in the strategy formulation process, we must ask ourselves the following questions and prepare answers.

1. Is the organizational structure need to be changed to accommodate the deployment of the strategy?

2. How many people’s job might be risked? What is the exiting plan for them?

3. How can we communicate effectively to instigate buy-in and break the resistance?

4. Should we revamp our motivation system so as to align with our strategy?

5. Is our culture compatible with our strategy? Do we need a culture shaking?

A right strategy only means a quarter of the way toward success. Many excellent strategies veer off the road due to the absence of capable people to carry it out. Quite often, we assume that our labor force is able to undertake the tasks and achieve the strategic goal. And the result frequently tells otherwise. A new strategy demands a better or different skill which usually is not possessed by existing employees.

For instance, the strategy requires employees to be “customer-centric,” but if the company paid little attention to customers in the past, the employees will have no idea how to interpret this principle or won’t know what a successful outcome would look like. So even at the planning stage, we should put this execution capability into consideration. The job should be done include:

1. Evaluate the employees’ current skill and check whether it meets the requirement of the new strategy. If the gap is foreseeable at the horizon, company must prepare necessary trainings to close it.

2. Appoint a strategic execution officer. It is a key ingredient often overlooked but is pivotal. The position requires not only commitment and energy, but also the ability to command resource and make tough decision to remove any obstacles in the way.

3. Create role models. In any organization, people model their behavior on “significant others”: those they see in positions of influence. So at very early stage, company should plan to build an elite team which fully embraces company’s strategy and also has the ability to permeate its influence to the lowest organizational level. When the influence is getting bigger and bigger, the strategy will also aggregate its momentum to move forward.

Strategy formulation is the most important activity of any organization. It requires a lot of effort and resource to make a sound one. A strategic planning process will never be a complete one without putting people element under consideration.

Sunday, August 5, 2007

Avoid three fallacies in China

Lately, I have been working on a strategic project for my company’s one underperformed business in China. What amazed me that the problem in this business is so similar to that of another business I mentioned in the blog. To reflect upon what we have done mistakenly, I summarize three fallacies my company should avoid in the future. I think it is also a good lesson for other multinational companies.

1. Procrastination fallacy. Usually the cycle from making investment decision to project completion takes years to conclude. In such a fast-moving market like China, even few weeks can make differences. We can't study something for six months before come up with a recommendation. Of course we need to cautious before we pour in big money, but sometimes we also need to be opportunistic and make quick decisions. If we move too slowly, the friendly market conditions existing before would evolve and become inhospitable. And suddenly we end up spending money either at wrong time or at wrong place.

2.Credulity fallacy. When came to investment analysis, the data from sales team was easily taken as concrete, actually it was not. Sales people usually are optimistic people. In my experience, the number given by them is always rosy. So we must eliminate the bias or decoration in the figure and scrutinize every assumptions. Here I can give some tips, when I check the sales forecast made by sales, I always ask them what is the rational behind their prediction. After a series of challenging questions, the number will become more reasonalbe which can greatly improve the quality of decision.

3. Over-investment fallacy. Usually it takes us more money to build the same production facility than our rivals. So we always have a much heavier burden to carry forward than others. For example, we built a factory with an investment of six million Euros in Shanghai, our local competitors told us they can build the same with the same figure but in RMB. (I am not sure whether it is exaggerated or not, but it tells something anyway). As a company values corporate responsibility, we need invest extra money on environment protection and work safety. But in such a hype-competitive market like China, over-investment by large scale will just kill us in the cradle, not mention to fight head by head with our local rivals who always enjoys low cost advantage.

Our company is very successful in Europe and North America. But we are always baffled by the unique market conditions in China. The key here is not just repeat our business model in the developed economic regions but we need to adapt ourselves to China game rules. Otherwise, we will just flop heavily.

1. Procrastination fallacy. Usually the cycle from making investment decision to project completion takes years to conclude. In such a fast-moving market like China, even few weeks can make differences. We can't study something for six months before come up with a recommendation. Of course we need to cautious before we pour in big money, but sometimes we also need to be opportunistic and make quick decisions. If we move too slowly, the friendly market conditions existing before would evolve and become inhospitable. And suddenly we end up spending money either at wrong time or at wrong place.

2.Credulity fallacy. When came to investment analysis, the data from sales team was easily taken as concrete, actually it was not. Sales people usually are optimistic people. In my experience, the number given by them is always rosy. So we must eliminate the bias or decoration in the figure and scrutinize every assumptions. Here I can give some tips, when I check the sales forecast made by sales, I always ask them what is the rational behind their prediction. After a series of challenging questions, the number will become more reasonalbe which can greatly improve the quality of decision.

3. Over-investment fallacy. Usually it takes us more money to build the same production facility than our rivals. So we always have a much heavier burden to carry forward than others. For example, we built a factory with an investment of six million Euros in Shanghai, our local competitors told us they can build the same with the same figure but in RMB. (I am not sure whether it is exaggerated or not, but it tells something anyway). As a company values corporate responsibility, we need invest extra money on environment protection and work safety. But in such a hype-competitive market like China, over-investment by large scale will just kill us in the cradle, not mention to fight head by head with our local rivals who always enjoys low cost advantage.

Our company is very successful in Europe and North America. But we are always baffled by the unique market conditions in China. The key here is not just repeat our business model in the developed economic regions but we need to adapt ourselves to China game rules. Otherwise, we will just flop heavily.

Friday, August 3, 2007

Nasty Boss

Today had a lunch with a friend this noon. Apparently she is not happy. She complains to me that she had a problem with her boss who bypasss her and micro-manages her department. Even worse, the boss belittled her in front of her subordinates. The war between she and he became now public, whereas the GM just wants to play good guy and is not willing to take a position.

It is quite common to see the managers holding micro-management mindset in an organization. They are the people who feel very uncomfortable when they don't know the exact details of what is going on in their territory. Unfortunately when they lay their eyesight over the tree, they lose the forest.

What disturbs me more is the disrespect my friend's boss inflicted on her, especially in public. It is distructive behavior, not only to my friend, but also to the whole group of people seeing the conflicts.

No one likes nasty people. And nasty managers make more damage than common nasty ones. They hamstring people's passion at work, they create a fearful working environment suffocating creativity and initiative, and they demorale the whole team.

So what we can do about it? How can we stop the disruption caused by nasty manager? The answer lies on building a civilized workplace where nasty people can not live.

1. Enforce the no-jerks rule. Excutives who want to create a harmonized workplace will not only take haphazard action against one jerk at a time, they use integrated set of work practice to battle the problem.

2.Make the rule public by you say, especially by you do

3.Weave the rule into firing and hiring policies

4.Teach people how to fight

Nastiness is contagious. If it is not rooted out from organization, it would create civility vaccum, suck the warmth and kindness out of everyone who enters and replace them with coldness and contempt.

So, senior managers must take action to prevent nasty behavior happening at a very early stage and consistently shape a no-jerks culture.

It is quite common to see the managers holding micro-management mindset in an organization. They are the people who feel very uncomfortable when they don't know the exact details of what is going on in their territory. Unfortunately when they lay their eyesight over the tree, they lose the forest.

What disturbs me more is the disrespect my friend's boss inflicted on her, especially in public. It is distructive behavior, not only to my friend, but also to the whole group of people seeing the conflicts.

No one likes nasty people. And nasty managers make more damage than common nasty ones. They hamstring people's passion at work, they create a fearful working environment suffocating creativity and initiative, and they demorale the whole team.

So what we can do about it? How can we stop the disruption caused by nasty manager? The answer lies on building a civilized workplace where nasty people can not live.

1. Enforce the no-jerks rule. Excutives who want to create a harmonized workplace will not only take haphazard action against one jerk at a time, they use integrated set of work practice to battle the problem.

2.Make the rule public by you say, especially by you do

3.Weave the rule into firing and hiring policies

4.Teach people how to fight

Nastiness is contagious. If it is not rooted out from organization, it would create civility vaccum, suck the warmth and kindness out of everyone who enters and replace them with coldness and contempt.

So, senior managers must take action to prevent nasty behavior happening at a very early stage and consistently shape a no-jerks culture.

Spend quality time with your customer

Today a bad news arrives. One of our product line was decided to withdraw from China market by the end of ths year. This is a tough decison which has been discussed and debated for almost one year. But the reality forces us to swallow this bitter pill. We have been left far behind our competitors. And even from global perspective, the product line is also struggling to survive. We have no choice but to scale back our operations.

However, we could have taken another road if we had addressed our problem earlier. Last month, I toured around the country from North to South to visit our customers. What surprised me is that I am the first one representing seniro management to lisen to the voice of our customers. And from them I also heard some startling news about our rivals. Our enemies not only give competative price to customer but also provide customer technique package by which customer can easily set their production parameters and achive quality output. But we sell our product at premium price without giving any technique support in real sense to out customers. This mignt not be the only reason but at least one of the reasons leading to our failures. We must spend more quality time with our customers, hear their voice and take their perspective in order to develop value-added solutions to them. This is essential to keep us alive in the bloody market competition. The following is an article from WALL STREET JOURNAL, speaking the same topic.

When Intel made a bid to become the microprocessor supplier for Apple's new Apple TV, Chief Executive Paul Otellini told his top engineers they needed to make some swift design changes.

Intel's microprocessors, which the company had begun supplying for Apple computers in 2005, met performance specifications but their traditional packaging had to be thinner and smaller to fit Apple's small set-top box that connects TV sets to a computer or the Web.

He heard grumblings that this change wasn't possible -- at least not anytime soon -- but Mr. Otellini pushed ahead. "Instead of saying no, we can't, let's say yes and figure out how," he recalls telling his senior team members. He won them over and soon had a new packaging design to show Apple, which chose Intel as its supplier.

It was a lesson in change and in how to approach customers, he says. "We're adjusting and tailoring products for them and moving much more quickly," explains Mr. Otellini, who came up through the sales and marketing ranks.

Top executives like Mr. Otellini find they are working more closely than ever with their customers, and listening and responding to their requests for product customization or service and training. They are becoming involved even in the nitty-gritty of contract negotiations.

"Ten years ago, a sales executive would have given a pitch, but today big customers want the CEO's commitment that if they buy from you, you're forming a partnership with them and will deliver exactly what you promised," says Ed Peters, chief executive of OpenConnect, a Dallas company that makes software that uncovers business-process inefficiencies. "And if you don't, your failure will be broadcast on the Internet and quash possible deals with other customers."

Mr. Peters says he spends at least 60% of his time on the road meeting with customers. Last week, he sat in on a sales presentation with a large global customer. His managers knew the client's business processes inside and out. But his customer wanted to hear from him how they would save on costs. Next, he'll meet with the client's top executives to give them more information.

Having the CEO make a "ceremonial visit" to only the biggest customers to tell them, "You're important to us," isn't cutting it anymore, says Kevin Coyne, a Harvard Business School professor. "They're getting substantively involved in the biggest deals, showing up for key parts of a negotiation," he says. And they're following up to make sure employees deliver what they've promised. At a time of product proliferation, they're thinking about customers around the globe, he adds.

Nike CEO Mark Parker recently met in Shanghai with 50 Chinese artists, fashion and industrial designers, and photographers who gave him "insights I wouldn't get reading an article about China," he says. "The message that came through was they want their own voice" and were concerned about being overwhelmed by Western products, he says.

He hopes Nike's concept of personalization appeals to them. The company has Web sites that allow anyone to customize a pair of shoes with different colors, trims or team names.

"I enjoy connecting with people" who influence the taste and cultural trends, adds Mr. Parker, who was named CEO last year. He says it is critical for all business leaders to connect with customers. Clients today, he says, are "highly individualized, want products that excite them -- and have more choices than ever."

For Mr. Parker and other CEOs, the must-see list is growing in number and variety. Nike has long used team sponsorships and star athlete endorsements to market its products and sought advice from athletes for its designs. But he also spends time with musicians, graffiti artists and other creative talent.

"I meet regularly with our biggest retail customers but I also go off the beaten path where I can stimulate the right side of my brain -- and discover new tastes in music, fashion, cuisine," he says.

At Sun Microsystems, Scott McNealy maintains a list of 50 large customers. His relationships with some of them have spanned his whole tenure at the company he founded, although he is now chairman, not CEO. "I have 25-year relationships with a lot of these people," he says.

Since stepping down as CEO last year, he has created a new job for himself circling the globe to keep in touch with his customers. Just this past Saturday, he had plans to fly to Japan to meet with clients, and to do the same in India and Germany before returning to the U.S. He estimates he does about eight or 10 events each day when he's traveling: scheduling lunch or dinner with scores of people, plus some one-on-one conversations with others.

Company CEO Jonathan Schwartz gets reports daily from Mr. McNealy about what happens in those meetings. Even so, Mr. Schwartz also spends time with the customers. "But unlike Jonathan, I don't have 15 direct reports who each want a piece of my mind, and I don't have to come back jet-lagged and run a staff meeting," says Mr. McNealy.

However, we could have taken another road if we had addressed our problem earlier. Last month, I toured around the country from North to South to visit our customers. What surprised me is that I am the first one representing seniro management to lisen to the voice of our customers. And from them I also heard some startling news about our rivals. Our enemies not only give competative price to customer but also provide customer technique package by which customer can easily set their production parameters and achive quality output. But we sell our product at premium price without giving any technique support in real sense to out customers. This mignt not be the only reason but at least one of the reasons leading to our failures. We must spend more quality time with our customers, hear their voice and take their perspective in order to develop value-added solutions to them. This is essential to keep us alive in the bloody market competition. The following is an article from WALL STREET JOURNAL, speaking the same topic.

When Intel made a bid to become the microprocessor supplier for Apple's new Apple TV, Chief Executive Paul Otellini told his top engineers they needed to make some swift design changes.

Intel's microprocessors, which the company had begun supplying for Apple computers in 2005, met performance specifications but their traditional packaging had to be thinner and smaller to fit Apple's small set-top box that connects TV sets to a computer or the Web.

He heard grumblings that this change wasn't possible -- at least not anytime soon -- but Mr. Otellini pushed ahead. "Instead of saying no, we can't, let's say yes and figure out how," he recalls telling his senior team members. He won them over and soon had a new packaging design to show Apple, which chose Intel as its supplier.

It was a lesson in change and in how to approach customers, he says. "We're adjusting and tailoring products for them and moving much more quickly," explains Mr. Otellini, who came up through the sales and marketing ranks.

Top executives like Mr. Otellini find they are working more closely than ever with their customers, and listening and responding to their requests for product customization or service and training. They are becoming involved even in the nitty-gritty of contract negotiations.

"Ten years ago, a sales executive would have given a pitch, but today big customers want the CEO's commitment that if they buy from you, you're forming a partnership with them and will deliver exactly what you promised," says Ed Peters, chief executive of OpenConnect, a Dallas company that makes software that uncovers business-process inefficiencies. "And if you don't, your failure will be broadcast on the Internet and quash possible deals with other customers."

Mr. Peters says he spends at least 60% of his time on the road meeting with customers. Last week, he sat in on a sales presentation with a large global customer. His managers knew the client's business processes inside and out. But his customer wanted to hear from him how they would save on costs. Next, he'll meet with the client's top executives to give them more information.

Having the CEO make a "ceremonial visit" to only the biggest customers to tell them, "You're important to us," isn't cutting it anymore, says Kevin Coyne, a Harvard Business School professor. "They're getting substantively involved in the biggest deals, showing up for key parts of a negotiation," he says. And they're following up to make sure employees deliver what they've promised. At a time of product proliferation, they're thinking about customers around the globe, he adds.

Nike CEO Mark Parker recently met in Shanghai with 50 Chinese artists, fashion and industrial designers, and photographers who gave him "insights I wouldn't get reading an article about China," he says. "The message that came through was they want their own voice" and were concerned about being overwhelmed by Western products, he says.

He hopes Nike's concept of personalization appeals to them. The company has Web sites that allow anyone to customize a pair of shoes with different colors, trims or team names.

"I enjoy connecting with people" who influence the taste and cultural trends, adds Mr. Parker, who was named CEO last year. He says it is critical for all business leaders to connect with customers. Clients today, he says, are "highly individualized, want products that excite them -- and have more choices than ever."

For Mr. Parker and other CEOs, the must-see list is growing in number and variety. Nike has long used team sponsorships and star athlete endorsements to market its products and sought advice from athletes for its designs. But he also spends time with musicians, graffiti artists and other creative talent.

"I meet regularly with our biggest retail customers but I also go off the beaten path where I can stimulate the right side of my brain -- and discover new tastes in music, fashion, cuisine," he says.

At Sun Microsystems, Scott McNealy maintains a list of 50 large customers. His relationships with some of them have spanned his whole tenure at the company he founded, although he is now chairman, not CEO. "I have 25-year relationships with a lot of these people," he says.

Since stepping down as CEO last year, he has created a new job for himself circling the globe to keep in touch with his customers. Just this past Saturday, he had plans to fly to Japan to meet with clients, and to do the same in India and Germany before returning to the U.S. He estimates he does about eight or 10 events each day when he's traveling: scheduling lunch or dinner with scores of people, plus some one-on-one conversations with others.

Company CEO Jonathan Schwartz gets reports daily from Mr. McNealy about what happens in those meetings. Even so, Mr. Schwartz also spends time with the customers. "But unlike Jonathan, I don't have 15 direct reports who each want a piece of my mind, and I don't have to come back jet-lagged and run a staff meeting," says Mr. McNealy.

Subscribe to:

Posts (Atom)